The Advantages of an HR Audit

By Kimberly Kafafian

You may be familiar with a financial audit, but what about an HR audit? Getting a pulse on your organization’s policies and procedures can be just as valuable as understanding your numbers. If you want your workforce and bottom line to thrive, it’s important to assess if your HR practices are running optimally, in compliance with regulations, and aligned with your strategic goals. Unfortunately, in my experience I’ve found that this task is often overlooked or not even considered. Many leaders simply don’t understand the advantages of investing in this valuable tool or the gains it can unlock. Let’s break down exactly what an HR audit entails and why you should conduct one.

What is an HR Audit?

An HR audit is a comprehensive review of your HR policies, procedures, documentation, and systems to assess their effectiveness, efficiency, and compliance with legal and regulatory requirements. In essence, it’s a proactive check of your HR functions that identifies areas for improvement and growth. Regular HR audits can help you strengthen operations, reduce risks, and create a workplace culture that fosters engagement, performance, and growth.

At Monarch Consulting, our HR audits focus on the following key areas:

Compliance Review

We take a deep dive into our client’s policies, procedures, and documents to ensure that they comply with all the current regulations.

Talent Management

Evaluating recruiting methods, onboarding systems, performance management processes, and employee development initiatives uncovers weaknesses and opportunities to drive success.

Compensation and Benefits

Assessing pay structures, benefit offerings, and employee satisfaction provides the intelligence you need to ensure your employees feel appreciated and rewarded, which is important for attracting and retaining talent.

Employee Relations

Analyzing employee feedback, workplace culture, and communication practices empowers you to create an environment where everyone feels valued and respected, helping to drive engagement, innovation, and the bottom line.

Documentation and Record-Keeping

We look at the accuracy and completion of record management, along with identifying appropriate digital tools to streamline processes so HR teams can put their efforts toward strategy rather than manual tasks.

Why an HR Audit Should Be a Vital Part of Your Organization’s Strategic Planning Process

Regular HR assessments provide the insights leaders need to position the company for long-term success while creating a work environment that supports employees at every level. Over the course of my career as an HR professional, I’ve seen first-hand the advantages comprehensive audits provide.

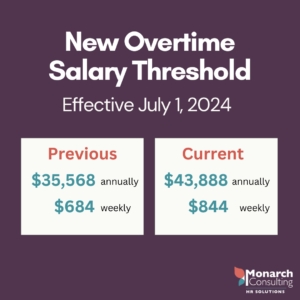

1. Ensuring Compliance and Reducing Legal Risks

Compliance is one of the top challenges organizations face as understanding and navigating employment laws can be quite complex. And non-compliance can be costly, as you face fines, lawsuits, and damage to your company’s reputation. An HR audit helps mitigate these risks by ensuring your policies and procedures align with current local, state, and federal regulations, and identifying and addressing potential issues before they escalate.

2. Improving Operational Efficiency

HR functions like recruiting, hiring, onboarding, payroll, performance management, and employee training are essential to the smooth operation of any organization. Inefficiencies in any of these areas can lead to wasted resources, poor applicant/employee experiences, and a lack of alignment with business objectives. An HR audit helps identify areas where you can make improvements. Perhaps a complicated onboarding process is frustrating new hires. Or maybe your performance management system isn’t providing the actionable feedback employees need to grow. An audit helps you enhance these processes.

3. Boosting Employee Engagement and Retention

Employee engagement is critical to retention, productivity, and overall business success. A poorly executed HR function can result in dissatisfaction, which may manifest in higher turnover rates and decreased performance. Auditing your HR functions can help you assess how well your HR practices are working to create a positive, engaging environment where your employees are motivated to do their best. For instance, evaluating your benefits offerings, compensation structures, and career development opportunities can ensure they are competitive and aligned with employee expectations.

4. Aligning HR Practices with Strategic Business Goals

HR can best drive growth when its practices align with the company’s values and overarching goals. The audit process assesses how well your talent management strategies, such as recruitment and training, coordinate with your business needs. It can help identify gaps in employee development programs or reveal opportunities for optimizing workforce skills. Aligning HR practices with business goals enables you to better support growth initiatives.

An HR Audit Spurs Long-Term Success

An HR audit can help your organization run more smoothly, stay compliant, and grow efficiently. Because it is inherently proactive, you can identify potential problems before they become major challenges, as well as uncover opportunities to mitigate risks and foster employee engagement and retention. Audits give you actionable recommendations for positive change.

En Español

En Español