By Dan Darabaris

Last month, millions of more workers became entitled to overtime pay as a result of a new rule from the Department of Labor (DOL). The update, which went into effect on July 1st, could have a substantial impact on your business, from decreased revenue to record keeping, as previously exempt employees may now fall within the salary threshold. I’m seeing businesses scramble to shore up compliance with the new rule.

Here’s What Businesses Need to Know About the Update

Increased Threshold

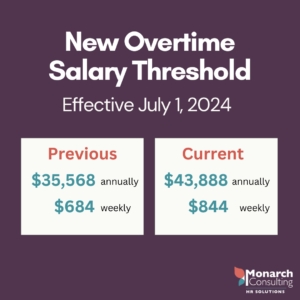

Under the Fair Labor Standards Act (FLSA), when most employees work over 40 hours per week, they are entitled to be paid more than their set wages. Overtime pay is mandated at time and a half for every hour worked over the 40 hours. The FLSA sets a salary threshold for determining which employees are exempt from the overtime requirement. Prior to the new rule, the threshold was $35,568 ($684 per week), which was set in 2019.

So what is the threshold now? The new figure is $43,888 ($844 per week).

Businesses need to look beyond the threshold, however, to determine if an employee is exempt from the overtime requirement. In order for an employee to be classified as exempt they must fall into the defined exemptions specified by the Department of Labor and the FLSA. Here is a list of the most commonly used exemptions, along with links that provide more detailed information on each:

- Executive Exemption https://www.dol.gov/agencies/whd/fact-sheets/17b-overtime-executive

- Administrative Exemption https://www.dol.gov/agencies/whd/fact-sheets/17c-overtime-administrative

- Professional Exemption https://www.dol.gov/agencies/whd/fact-sheets/17d-overtime-professional

- Computer-Related Exemption https://www.dol.gov/agencies/whd/fact-sheets/17e-overtime-computer

- Outside Sales Exemption https://www.dol.gov/agencies/whd/fact-sheets/17f-overtime-outside-sales

- Highly-Compensated Exemption: https://www.dol.gov/agencies/whd/fact-sheets/17h-overtime-highly-compensated

Highly Compensated Employees

The DOL also increased the threshold for what are referred to as “highly compensated employees” (HCE) from $107,432 to $132,964. Exemptions for HCEs also must pass a three-prong test:

- Minimum earnings of $132,964 in total compensation, including at least $844 per week on salary or fee basis

- Perform office or non-manual work as their primary duty

- Regularly perform at least one exempt duty of an executive, administrative, or professional employee

Future Increases

In addition to setting a new threshold for this year, the DOL has also planned for further increases. On January 1, 2025, the threshold will be set at $58,656 annually ($1,128 weekly), and at $151,164 for HCEs. The threshold will increase yet again on July 1, 2027, and then every three years after that.

How You Can Take Steps to Be Compliant

- Review the salaries and duties of each employee and compare them to the exemptions.

- Note all additional employees that now fall within the threshold requirement.

- Consider how the new requirement may impact your profits. You may determine to limit overtime. If you do so, be transparent with your workers as to why they cannot work later by developing a communications plan about the new rule.

- If non-exempt employees do work overtime, make sure you are compensating them for it.

- Some state requirements are even higher than the Federal minimums. Make sure to check your state specific requirements.

Classifying employees is a complicated task that can carry heavy penalties from the Department of labor if done incorrectly. Monarch Consulting has experts on staff to help with this process, consider reaching out to help us guide you through this new change. Connect with us to learn more.